Picture supply: Getty Picture

It’s been a few years since I final thought-about shopping for shares of Spotify Expertise (NYSE: SPOT) for my ISA. Over this time, they’ve risen greater than 100% and I’m regretting my resolution to not make investments.

Clearly, the inventory is hitting all the suitable notes with traders. So I’m again for one more look.

Why I didn’t make investments

As a worldwide chief in podcasts and music streaming, Spotify already has so much going for it. However I like that it nonetheless has engaging adjoining market alternatives in movies, occasions, audiobooks, e-commerce, in addition to its targeted-advertising enterprise.

Crucially, it has sensible management in forward-thinking co-founder and CEO Daniel Ek.

So why have I by no means owned its shares?

In a phrase, competitors. Particularly, the tech juggernauts which have caught ‘music’ after their identify and supply the identical service: Apple Music, Amazon Music, YouTube Music, TikTok Music. This nervous me.

However the unusual factor is, I don’t use any of these apps. I’m a Spotify Premium member, together with 236m different subscribers worldwide on the finish of 2023. So I already understand how sticky the platform is.

My authentic worry was that each one this competitors would stop the corporate from having pricing energy to develop revenue margins over time.

In different phrases, I used to be nervous that it might elevate costs by just a few quid and droves of listeners would soar ship to cheaper rivals. And naturally, Spotify has much more to lose as a pureplay streaming agency.

Rising globally

Because it seems, I needn’t have nervous. The corporate is seeking to enhance costs in a number of key markets for the second time in 12 months, and this hasn’t affected development.

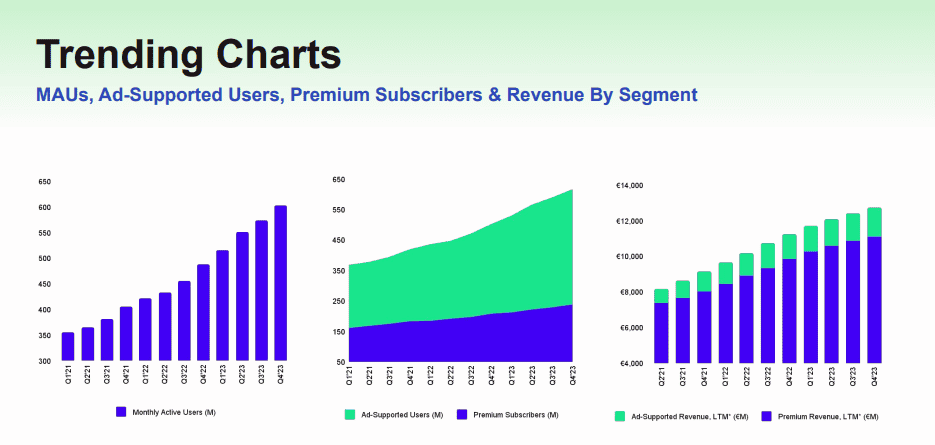

Final 12 months, income grew 13% 12 months on 12 months to €13.2bn. And month-to-month energetic customers (MAUs) reached 602m, up 23% from the tip of 2022. The variety of paying premium subscribers rose 13% to 236m.

It did put up a €532m internet loss although, and has misplaced cash yearly since going public in 2018. However now that the platform is reaching monumental scale, administration is laser-focused on producing earnings.

It has reduce prices, raised costs and this 12 months analysts see €1.4bn of free cash flow from €15.5bn in income. Subsequent 12 months, there’s a forecast €1.1bn internet revenue.

The fly within the ointment, nonetheless, is valuation. The inventory is buying and selling on price-to-free-cash-flow ratio of 40 for this 12 months and 32 for 2025. This can be a premium worth, which provides a component of danger.

Innovation

Having mentioned that, I believe the agency has constructed a sturdy aggressive benefit. Whereas music streaming is arguably an afterthought for Amazon and Apple, Spotify is ‘all-in’ on audio.

This implies it constantly invests in progressive applied sciences to enhance the consumer expertise. For instance, it makes use of algorithms to recurrently curate personalised playlists primarily based on consumer listening habits.

Extra not too long ago, it has launched AI-powered DJs and a ‘Merch Hub’, which recommends music-related merchandise.

With over 600m common listeners on the platform, the long-term promoting alternatives seem vital. And Spotify might additional enhance its premium costs (and due to this fact earnings) by bundling podcasts in with audiobooks and music.

Consequently, I’ve promoted the inventory to my watchlist to control. I’d make investments on any vital dip.